If you Explore a property Equity Loan to cover College?

Lea Uradu, J.D. was a beneficial Maryland Condition Registered Tax Preparer, County Official Notary Social, Official VITA Tax Preparer, Irs Yearly Filing Year Program Fellow member, and you may Income tax Publisher.

Going to university will cost you a fortune. With regards to the Studies Investigation Effort, college-relevant expenditures “more than doubled regarding twenty-first century.” So it may come as the no surprise you to student loan financial obligation is actually getting together with stagging levels. After the original one-fourth of 2024, they struck a staggering $1.six trillion.

For people without the offers to pay for substantial price of university today, experiencing family collateral thru a house guarantee loan is actually a great very glamorous choice. For the Q1-2024, People in america have been standing on $ trillion in home guarantee. not, the essential enticing choices isn’t really constantly the correct one to suit your overall financial well-getting.

Professionals

You might use more money having fun with a home guarantee financing than just you’ll with student loans. It indicates you could potentially give yourself a larger pillow getting unexpected expenditures without using your coupons so you can base this new student’s school expenses.

Family security fund are usually cheaper than other designs out-of personal debt. Since they’re shielded by the home, they usually have down interest levels, and this saves you money finally. If you’d like to allow for the baby’s training, a house equity financing may be the only way for your requirements to come up with the large lump sum payment required for a great semester’s university fees.

Even in the event you are whenever the debt, you give your youngster a loans-100 % free begin after they scholar. You will be capable exercise one thing after they score its earliest business to help subscribe to paying the home security financing.

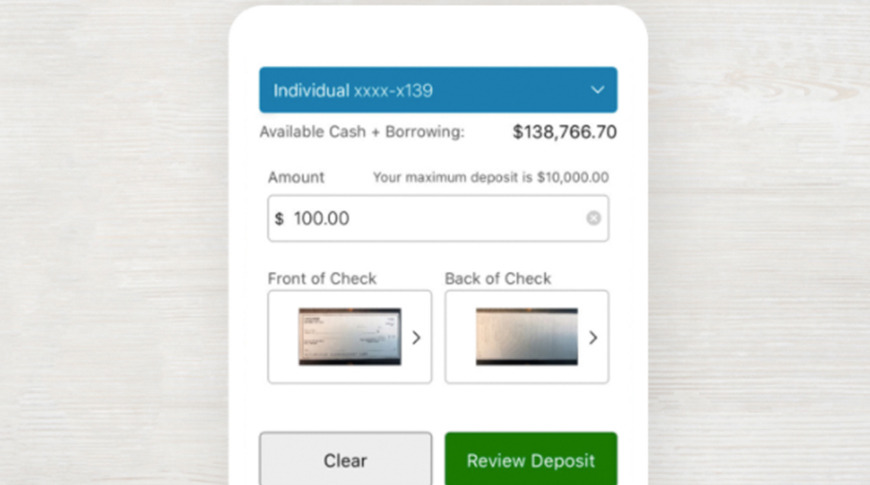

House guarantee fund let you borrow secured on the new available security in the your house. Below are a few Investopedia’s listing of greatest HELOC financing out of 2024.

Cons

You place your house at stake by the borrowing from the bank to fund your own baby’s education. If for example the financial predicament alter-your cure your job, your pay falls, your wife/partner passes away, or you keeps unplanned issues-you will possibly not have the ability to pay the loan. The lending company may start property foreclosure proceedings.

You will be leading to current or and when the fresh personal debt. This can lay a primary drop on your financial situation, particularly when you may be close to or already resigned. It can also be an encumbrance without having because much income as you performed previously.

You might be in addition to taking on more debt for an individual just who may well not end the education or somebody who can take extended accomplish the amount. The latter situation can result in a lot more will set you back and expenditures.

Thanasi Panagiotakopoulos, a certified monetary coordinator and founder out-of LifeManaged, states having fun with house equity to cover school might be an effective last resource. His customers are usually within their past phase away from buildup and you can lack time for you deal with new expense going on retirement.”

Possibilities to using a payday loans Wyoming property Security Financing to cover College

Buying college or university are going to be challenging, specifically with the present high will cost you. For individuals who still have date before you can have to pay having college, doing good 529 bundle now and putting as frequently aside due to the fact possible normally place you from inside the a much better spot once the first tuition statement is born. The possibility beginner may want to consider planning to a far more sensible college or university, providing its standard knowledge standards as a consequence of a less expensive neighborhood college or university earliest, and you will obtaining all grant options available.

If you find yourself planning to become an empty nester, upcoming offering your house, downsizing so you can something faster, and ultizing a few of the continues to fund college or university can also be getting ways to power your own home’s security versus trying out even more obligations.

When you’re student loans may have shockingly high rates of interest, they typically cannot feel due to own percentage up to half a year just after new scholar features finished-and several fund, for example backed federal direct finance, don’t accrue interest during those times. Whenever you are your own pupil continues to be at school, you could begin investing on their money if you want to enable them to buy college or university but never feel the method for exercise up front. Costs produced while they’re nevertheless at school could well be applied straight to the main and certainly will help them repay its finance faster once graduation.

What’s a property Security Mortgage?

A house guarantee loan are that loan to possess a predetermined number that makes use of the fresh new security you’ve got of your home as the security into financing. The loan provides repaired monthly premiums, generally speaking which have a predetermined rate of interest more a specified period of big date. If you’re unable to shell out your loan right back, then you could reduce your home to foreclosure.

Was House Security Finance Pricey?

Household guarantee loans are usually cheaper than personal debt, such as an unsecured loan otherwise charge card, since they are covered by using the security you have got for the your residence since equity.

Try Household Equity Loans Regarded as Assets to your Totally free Application to own Federal Scholar Assistance?

This new Free App having Federal Scholar Services (FAFSA) cannot amount equity of your property against your, but when you are taking one guarantee out by way of a home security mortgage, it will think about the money that you gotten during your loan due to the fact a valuable asset counterbalance of the loans of one’s loan. Along with FAFSA, many personal schools possess financial aid programs that can or can get not thought collateral on your own no. 1 quarters regarding aid qualifications. Consult your school having specific laws and regulations.

If you Co-Sign Figuratively speaking?

Co-signing another person’s college loans was risky and must qualify merely as a past resort. Not as much as most recent laws, student education loans might be hard to launch as a consequence of case of bankruptcy. For many who co-to remain financing for an individual which gets not able to outlay cash right back, then you will be on the newest hook up for them.

The bottom line

Investing in college is astronomically unaffordable over the last few years in the the same time one house guarantee features skyrocketed. Taking out a property guarantee mortgage to fund college or university is also getting an attractive option, however, take into account the risks-specifically, that you may possibly clean out your home so you can foreclosure if you’re unable to match costs before you sign up to your mortgage. There are many different ways to make school economical, so be sure to fatigue all of the choices prior to taking aside an effective home collateral loan to cover it.