Shape step one: MMDI 2023 Q3 dash getting GSE funds

The new Milliman Financial Standard Directory (MMDI) is a life default rates guess determined on mortgage peak for a portfolio from single-relatives mortgage loans. Towards the reason for that it index, default is described as a loan that’s likely to be 180 weeks or higher outstanding over the life of the loan. 1 The outcome of your own MMDI reflect the most up-to-date data acquisition offered by Freddie Mac and you will Fannie mae, that have aspect schedules including .

Key conclusions

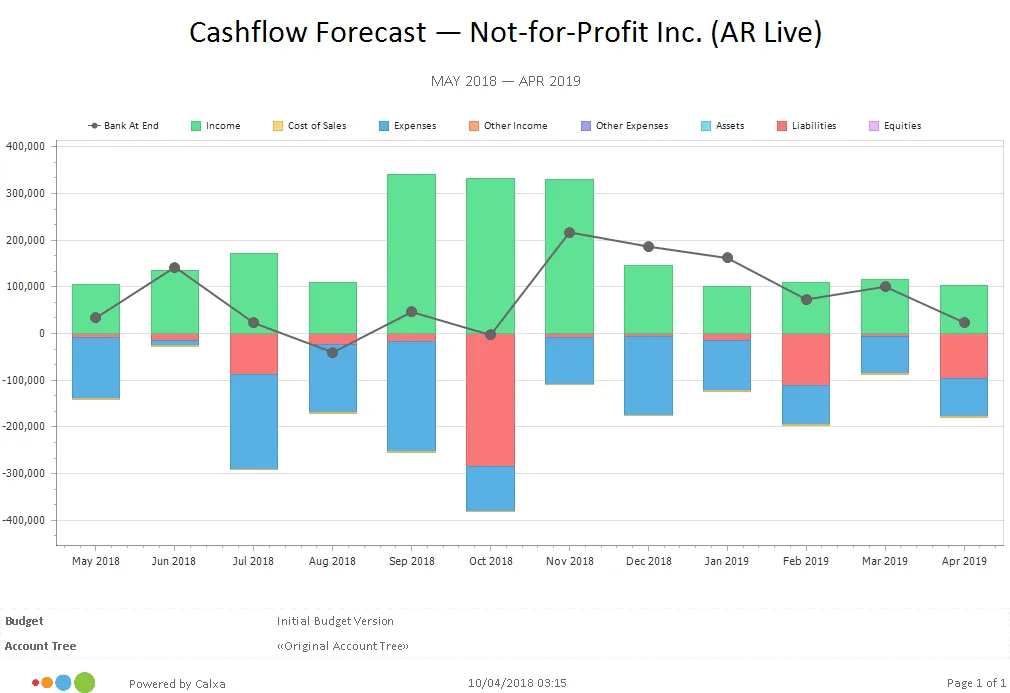

To have loans gotten on the third one-fourth (Q3) from 2023, the value of the brand new MMDI risen up to step 3.10%, up regarding step 3.03% getting fund received inside the 2023 Q2. So it increase stems from a slowing and moderate decrease of household speed like forecasts in a number of segments. Figure step 1 comes with the one-fourth-prevent directory efficiency, segmented of the buy and you may refinance money.

When examining quarter-over-quarter changes in the newest MMDI, it is critical to observe that new 2023 Q2 MMDI beliefs was basically restated as our history book, and you can was in fact modified of step 3.02% to three.03%. This can be a direct result upgrading both real household rates moves and you can predicts getting upcoming home speed really love.

Review of styles

More 2023 Q3, the latest MMDI overall performance demonstrate that home loan chance has increased having government-paid enterprise (GSE) acquisitions. You will find around three parts of the MMDI: borrower exposure, underwriting chance, and you can financial exposure. Borrower chance strategies the possibility of the mortgage defaulting because of borrower credit quality, 1st equity updates, and debt-to-income proportion.

Underwriting chance steps the risk of the mortgage defaulting due to mortgage unit have eg amortization particular, occupancy updates, or any other issues. Financial risk measures the risk of the mortgage defaulting on account of historic and believed economic climates.

Debtor exposure performance: 2023 Q3

Debtor chance Q3, that have purchase financing continuous and come up with in the bulk of originations around 89% off full regularity. Regardless of if get frequency might have been decreasing seasons-over-year, the caliber of finance from a risk position provides proceeded to be good, remaining the latest default danger of this new mortgage originations lower.

Underwriting exposure overall performance: 2023 Q3

Underwriting exposure means even more exposure alterations for possessions and you will mortgage features instance occupancy reputation, amortization variety of, documentation designs, mortgage identity, or other changes. Underwriting exposure stays low and is bad to buy mortgages, which are often complete-documentation, fully amortizing financing. Getting re-finance money, the information and knowledge try segmented toward bucks-out re-finance money and you may rates/term refinance funds.

Which one-fourth, around 70% regarding re-finance originations were bucks-aside refinance funds. Recent develops within the interest levels have made rates/label refinance low-monetary.

Monetary risk performance: 2023 Q3

Financial exposure try measured because of the thinking about historic and estimated domestic prices. To possess GSE money, financial risk improved quarter more quarter, from.54% inside the 2023 Q2 to at least one.64% inside 2023 Q3. Adopting the boom into the property costs you to took place over the movement of the pandemic, home rates really love might have been estimated in order to slow and also quite reduction of particular areas. The newest estimated reduction of household rate admiration has actually brought about a little upsurge in standard chance to own 2023 Q3.

To learn more about the latest housing market, delight consider the previous Milliman Perception blog post, Predicting the housing industry: A monetary outlook out of casing value and you will home prices offered by

Brand new MMDI shows a baseline forecast out of upcoming home prices. With the the quantity actual otherwise standard predicts diverge throughout the latest forecast, upcoming publications of your MMDI varies accordingly. For more detail towards MMDI areas of exposure, see milliman/MMDI.

Towards Milliman Financial Standard Directory

Milliman try professional into the examining complex investigation and you can building econometric habits which might be clear, intuitive, and you can informative. I have utilized our very own systems to greatly help several clients inside the developing econometric activities getting evaluating financial exposure one another within section off product sales as well as experienced mortgage loans.

The fresh new Milliman Mortgage Default Directory (MMDI) spends econometric modeling to develop a dynamic model that is used by the members inside the several indicates, plus looking at, overseeing, and you will ranks the financing top-notch new design, allocating upkeep source, and developing underwriting guidelines and you can cost. Due to the fact MMDI provides an existence standard price imagine on mortgage top, it is used by clients due to the fact an excellent benchmarking tool during the origination and repair. This new MMDI are constructed because of the consolidating about three important elements away from mortgage risk: borrower credit quality, underwriting characteristics of your own mortgage, in addition to economic ecosystem made available to the mortgage. This new MMDI uses a powerful data gang of over 29 billion mortgages, which is updated frequently to be certain it holds the greatest peak away from reliability.

Milliman is among the largest independent asking agencies throughout the globe and contains developed procedures, units, and possibilities all over the world. We’re acknowledged frontrunners regarding avenues i serve. Milliman understanding is at across the international boundaries, offering formal consulting functions into the home loan banking, worker advantages, healthcare, life insurance coverage and economic features, and you will possessions and casualty (P&C) insurance. Within these circles, Milliman specialists suffice many newest and you will growing segments. Website subscribers know capable trust us due to the fact skillfully developed, leading advisors, and creative state-solvers.

Milliman’s Home loan Behavior are serious about bringing proper, decimal, or other consulting qualities so you’re able to top teams on the financial banking globe. Previous and newest website subscribers include certain country’s largest financial institutions, apply for loan with bad credit on line individual mortgage warranty insurers, monetary guarantee insurance agencies, organization buyers, and you can political communities.

step 1 Such as for example, whether your MMDI is 10%, upcoming we anticipate ten% of mortgages originated from you to definitely times to become 180 days or even more delinquent more than their lifetimes.